Understanding the SWIFT MT103 Form: Complete Guide

SWIFT Form MT103 – the standard payment confirmation form in cross-border SWIFT transactions, also known as “Single Customer Credit Transfer”. If you have sent a SWIFT transfer and the recipient has not received it within 3 working days, the first thing you should do as an issuer is to ask your bank for this form. Banks can sometimes call it by different names, such as “transfer details,” “transfer receipt,” or “payment confirmation.” In this article, we’ll go over examples of MT103 forms from different banks.

What is a SWIFT MT103 form?

It is a detailed document generated when you make an international SWIFT transfer at your bank. It serves as a confirmation of the payment made from your bank and informs the payee’s bank of all the details of the transaction, including any fees applied. At a minimum, it is supposed to inform the beneficiary’s bank, although it can sometimes get stuck in intermediary banks.

The MT103 is a somewhat old-fashioned document structure, created back when the COBOL programming language reigned supreme. Now, SWIFT promises to replace it with a modern XML-based structure using the ISO 20022 format. However, for now, we mainly see the traditional MT103 in use.

What does the MT103 form look like?

The MT103 may be supplied on the bank’s official template with a logo, but sometimes it can look like a TXT file snippet of SWIFT systems. It doesn’t really matter. What is important is to understand the meaning of the fields.

Here, in the example, you can see a SWIFT transfer from the Montenegrin bank Hipotekarna. They automatically email this form when the payment has been processed.

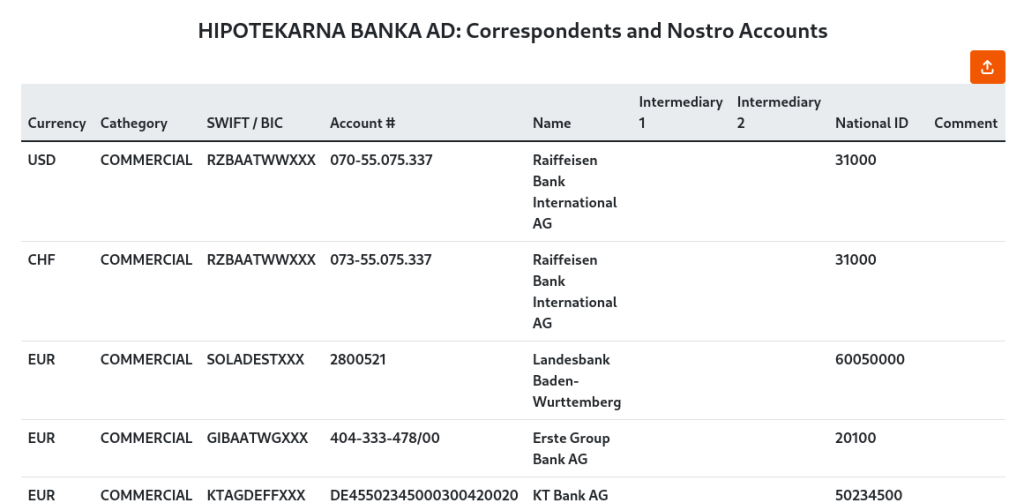

First, look to the right – the recipient of this form is RZBAATWWXXX. While you can assume that this is the beneficiary’s bank, this is not entirely true. It is the correspondent bank for transfers in euros on behalf of Hipotekarna. This is not a general rule, but very often the correspondent bank is in the header, and this information can be quite useful.

In the User Header section, you can see the field :121: with the UETR code. It is not mandatory to have it on the MT103 form, but you are lucky if it is included. It always follows the same format: XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX.

The UETR code is the only universal identifier for each SWIFT transaction. It’s universal because it doesn’t change throughout the transaction process, and if you ask any bank in the chain where it’s located, theoretically, they can track it.

In field 20, you will find the Transaction Reference Number, often referred to as the Issuer Reference Number. Each bank in the chain assigns its own reference number. Although the UETR code is more universal, sometimes it is enough to have the Issuer Reference Number to track the payment. It is also more convenient when contacting the bank.

In field 32A you can see the amount, currency, and date of the transaction. Make sure you read the date correctly, it is usually formatted as YYMMDD. So, in this example, 5220 euros were sent on November 2, 2022. When you speak with the bank representative, they usually refer to this data as:

- Value Amount or Issuer Amount

- Value Date

- Issuer Currency

On the second page of the form, we see the details about the issuer and payee of the payment:

In the 50K field, you can see the details of the issuer, including their account number, name, and address. In field 57A, you can see the SWIFT/BIC code of the beneficiary’s bank.

Other examples of MT103

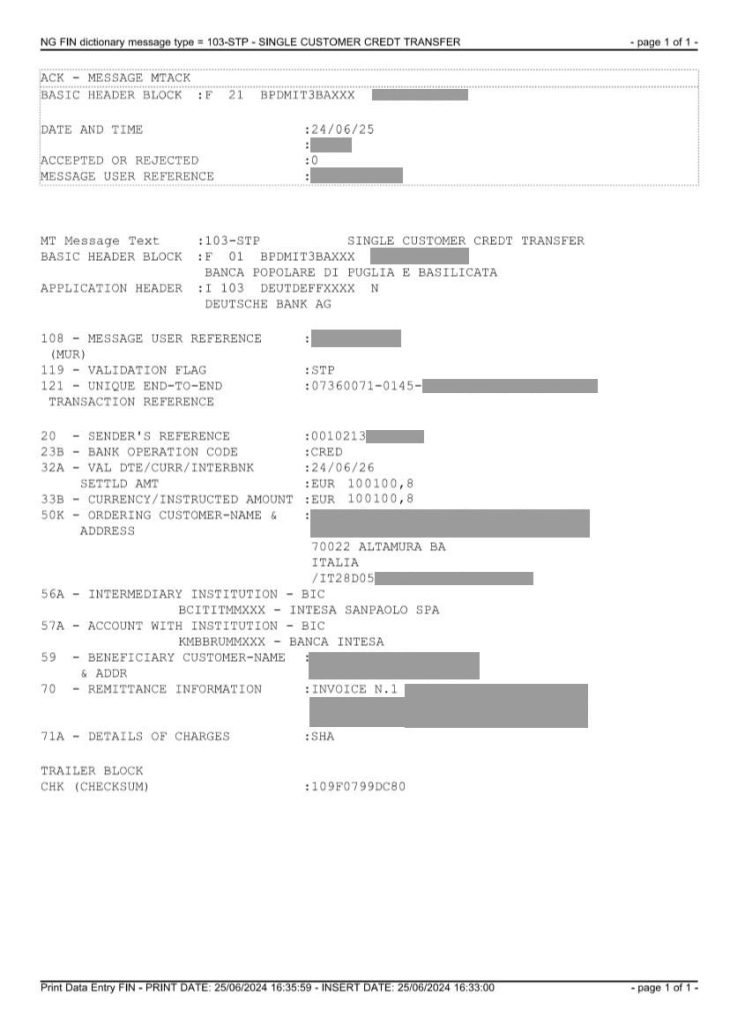

Here is another example of an MT103 form from an Italian bank. In the lead, we can see that it was sent to Deutsche Bank, where the bank maintains its corresponding account (nostro). In field 121 of the header, you can see the UETR code. In the body of the form, there is a reference number, a value date (June 26, 2024), the amount – 100,100.80 EUR, and the name, address, and account number of the issuer. In field 56A, you will find the correspondent bank of the beneficiary bank. In field 57A, you will find the beneficiary’s bank. Field 70 contains the payment details. “SHA” in field 71A means that the costs for the transfer are shared between the issuer and the recipient.

Why do you need the SWIFT MT103 form?

If you have sent a SWIFT transfer and it has not been credited to the beneficiary’s account within the usual time frame, such as 3 working days, you need to take action, especially if you are in a hurry. One of the first steps you can take is to ask the recipient to go to their bank and check if they can see the transaction. However, it could be difficult for the bank to identify it without specific details. Providing them with the MT103 form will make their job much easier.

You can also try tracking a SWIFT payment and you will need the data from the MT103 form, such as UETR code or payment reference, date, amount, currency. You probably won’t see exactly where the transfer is at that exact moment, but you can check if it was rejected or not, and also check if there have been any updates since the last time you checked.